BMO for Women: Financial Forecasting Workshop

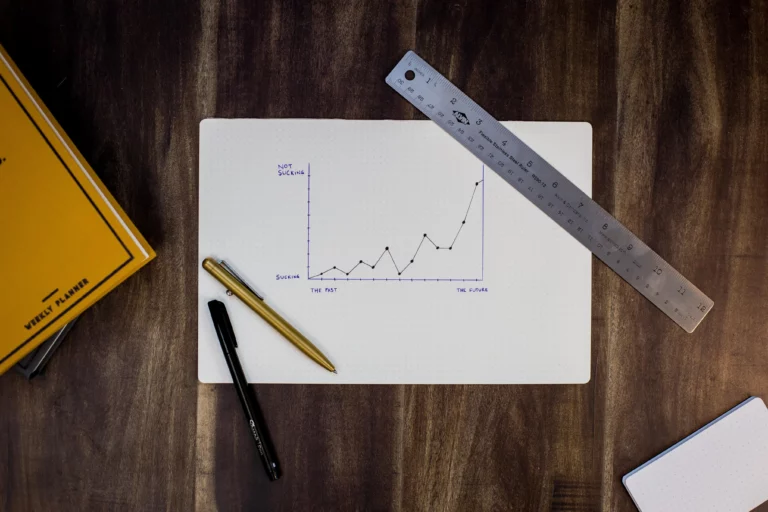

BMO’s Jamie Doolittle, Head of BMO Business Banking for Central Region, Ontario, hosts Heather Tuason, CEO of Arena CEO, for a discussion about Financial Forecasting – the New Year’s resolution that pays off.