Take these 6 easy 30-60 minute steps to actively manage your cash flow

50% of businesses fail by their 5th year.

~ Small Business Administration

82% of those failed businesses say it is because of cash flow.

What the heck is cash flow?! Cash flow for a business is critical to keeping your business going, paying your employees on time, and making sure you have your product available when your customer needs it. Understanding cash flow is critical to a business’ success. Here is a simplistic way to view cash flow: money in and money out. The most complex element is managing the time between.

Time is difficult to manage in a business due to the timing of customers paying (money in) and the demands of inventory and personnel cost (money out). Here are 6 easy ways to begin thinking about cash flow and creating a proactive approach to managing it:

1. Create a financial forecast

Did you know that 90% of businesses do not have a financial forecast? Some have budgets, but that simply looks at the money a business spends. By taking 30-60 minutes to do a lightweight forecast for your business you will already be setting yourself apart from your competition.

Creating a lightweight financial forecast is easy.

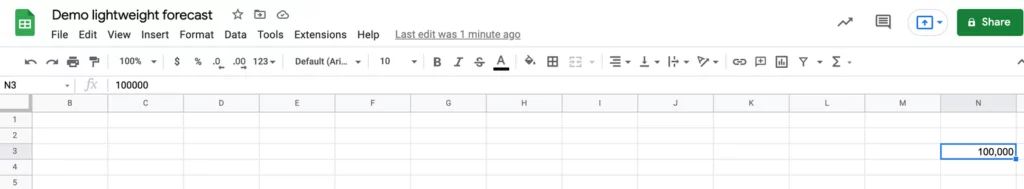

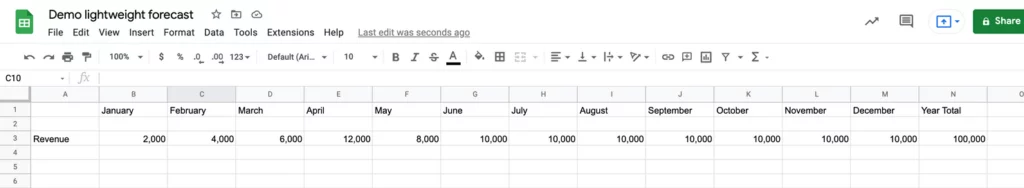

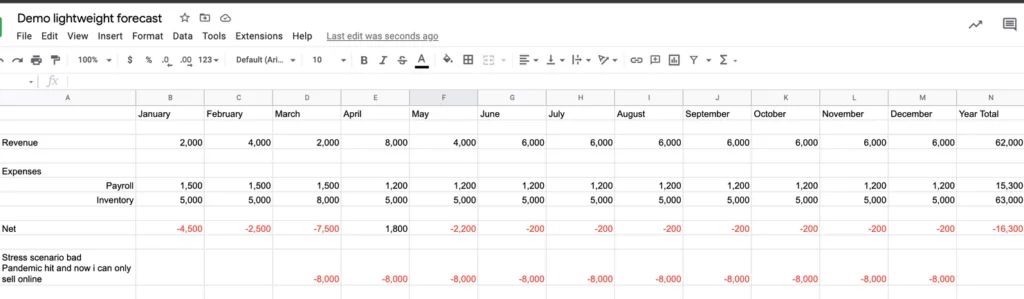

Start with 1 question. How much money do you want to make this year? Place that number in column N on a spreadsheet.

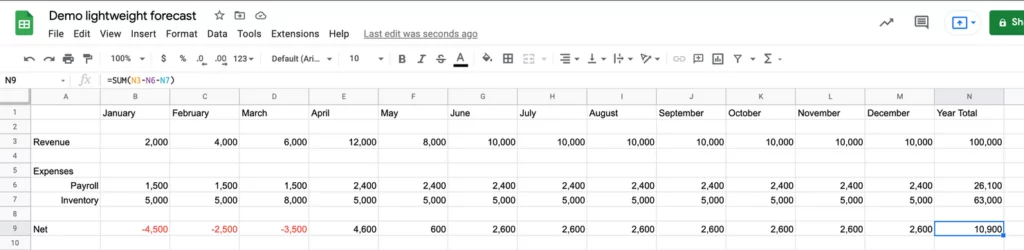

Divide that number up over the 12 months of the year. Note that this does not need to be evenly spread across the months, it should represent the seasonality of your business and/or the intended growth that you expect.

Now add in your known costs.

Once you have this baseline, you can clearly see the months you will be in the hole and the months where you will have profits. You can then begin adding Marketing, Operational costs, and other categories to get a more granular view of where money is going and which categories are levers for you to adjust along the way. You will also have a view of months where you anticipate needing to borrow or dip into savings so that you can ensure those funds are available well ahead of time.

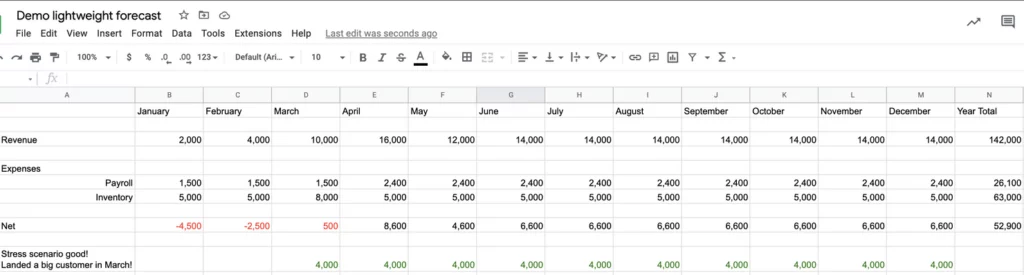

2. Stress it

Now apply a couple of scenarios to it – a good scenario for your business like landing a big customer and a bad one, like a pandemic. This 20-30 minute activity will help you become aware of the levers within your business that can and maybe should be changed during the good times and the bad.

3. Measure it

Now that you have your forecast it is very important to measure it on a regular basis, monthly is a recommended frequency to look at your actual performance vs. what you predicted in your forecast. When you see the differences, examine it, know why that happened. Maybe you need to adjust your forecast and prediction for your business because you did not consider all of the costs or sales. Maybe you need to reconsider a business strategy to ensure you can stay on track to your original ambition…the amount you wanted to make this year.

4. Know your cash and credit position

Most business owners know the balance in their checking account every day of the week but that is not all you should be tracking. On a monthly basis see what your total access to cash and credit is. Once you know that number check out your forecast and see if it is what you need to weather a downturn and cover your expenses. If it is not or if it is close, you should begin thinking of ways to close that gap by making adjustments to your business and/or getting additional capital.

5. Know your unit cost

Knowing your unit cost is another 30 minute activity that will help you make better decisions on pricing and costs for your business. What does it cost you to deliver 1 unit of your product or service to a customer? This number should include marketing expenses and overhead costs for your business. Once you know this number you might decide you need to increase your prices. Learn more about adjusting your pricing and considerations to think about in our Successfully managing a business through inflation blog post.

6. Improve your Cash Conversion Cycle

One of the ways you can ensure that your business is generating a positive cash flow is measuring cash conversion cycle (CCC). A cash conversion cycle is “a key performance indicator (KPI) that measures how long it takes for a dollar spent on anything (rent, utilities, marketing, payroll, etc.) to make it through your business and back into your pocket.” The goal is to get money in the bank before you need to spend it, or in other words, to generate a negative CCC (i.e. -6 days). You can shape your cash conversion cycle by changing the way your business functions in multiple areas, including your sales, delivery, production, and billing and payment cycles. For instance, you can improve your CCC by collecting payments in full before production. This way you’ll only spend on inventory when necessary. If you’re wanting to accelerate your cash conversion cycle check out our blog post on CCC management called How to improve your Cash Conversion Cycle.

Taking on one of these 30-60 minutes activities each week can set your business up for success allowing you to know how your business is performing and knowing when you might need to make adjustments. If this still sounds like a daunting task or you are looking to take your financial management to the next level for your business we are here to help.

Need some help planning for your financial future and modifying your pricing strategy? Set up time with a financial expert at Arena today! https://www.arenacfo.com